The U.S. apartment market continues to showcase remarkable stability, with occupancy rates holding steady at 94.1% for August 2024. This marks the 10th consecutive month where occupancy has fluctuated by no more than 10 basis points (bps) in either direction. The minuscule difference between July (94.16%) and August (94.13%) underscores this stability, as the 0-bps change was rounded up from -0.03. This subtlety highlights the market’s consistency, where even a rounding adjustment is needed to notice any difference in monthly performance.

Rent and Occupancy Trends

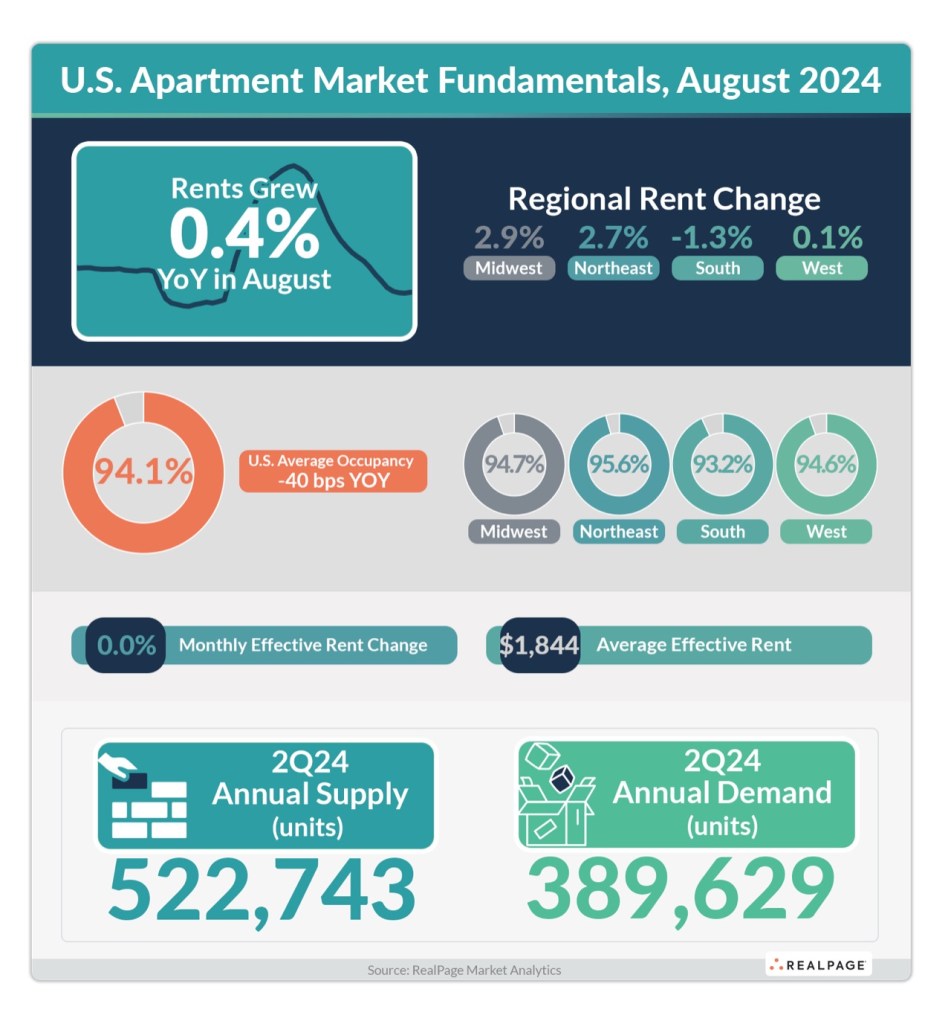

Despite mild downward shifts at the end of 2023, August 2024 occupancy remains 40 bps below the same period last year, according to RealPage Market Analytics. Rent changes have also remained stable, with year-over-year growth modest at just 0.4%, significantly below the nation’s decade average. For the past 13 months, annual rent growth has not exceeded 0.4%, reflecting a period of sustained mild growth.

Regional Performance Highlights

The Midwest and Northeast regions have emerged as the top performers in rent growth, with prices increasing by 2.9% and 2.7%, respectively, over the past year. Among the nation’s 50 largest apartment markets, Milwaukee, Washington, DC, and Kansas City led the charge with rent increases between 3.4% and 3.6%. Conversely, Austin experienced a significant rent decline of over 8% in the past year, nearly double the rent cuts seen in other major markets nationwide.

Revenue and Market Dynamics

While U.S. apartment revenues have not yet resumed growth, they have at least stabilized. Year-over-year revenue change has been 0% for two consecutive months, halting the 13 consecutive months of annual revenue loss that preceded this period. Markets with revenue growth of 3% or more in the past year include Detroit, Washington, DC, Richmond, and Virginia Beach.

Conclusion

The U.S. apartment market’s stability amidst subtle shifts in occupancy and rent growth presents a unique landscape for investors and renters alike. As the market continues to navigate these trends, the consistent performance in certain regions and the stabilization of revenues offer a glimpse into the future dynamics of the apartment sector. Engage with us in the comments below to share your thoughts on these trends and what they mean for the broader real estate market. Let’s start a conversation!

Sources:

(1) U.S. Apartment Market Sees Negligible Change in August – RealPage. https://www.realpage.com/analytics/august-2024-data-update/.

(2) U.S. Apartment Demand Surges in 2nd Quarter – RealPage. https://www.realpage.com/analytics/2nd-quarter-2024-data-update/.

(3) U.S. Apartment Occupancy Hits Decade Low – RealPage. https://bing.com/search?q=U.S.+Apartment+Market+Sees+Negligible+Change.

(4) U.S. Apartment Occupancy Hits Decade Low – RealPage. https://www.realpage.com/analytics/us-occupancy-below-decade-average/.

(5) U.S. Apartment Demand Plunges in 3rd Quarter as New Leasing … – RealPage. https://www.realpage.com/analytics/us-apartment-demand-plunges-3rd-quarter/.

(6) 1st Quarter 2024 Apartment Update | RealPage Analytics Blog. https://www.realpage.com/analytics/march-2024-data-update/.

Leave a comment