In a bold move, the Federal Reserve has issued its first interest rate cut in four years, initiating an easing cycle that promises to make new mortgages more affordable. This significant policy shift, announced on Wednesday, saw a half-point reduction in the central bank’s benchmark rate, bringing it down to approximately 4.8% from a two-decade high of 5.3%.

A Larger-Than-Expected Cut

The half-point rate cut exceeded market expectations, which had anticipated a more modest quarter-point reduction. This aggressive cut signals the Fed’s confidence that inflation is under control and its focus has shifted to preventing a recession and significant job losses. The move is expected to lower borrowing costs for both consumers and businesses, with mortgage rates already showing a downward trend.

Impact on Mortgage Rates

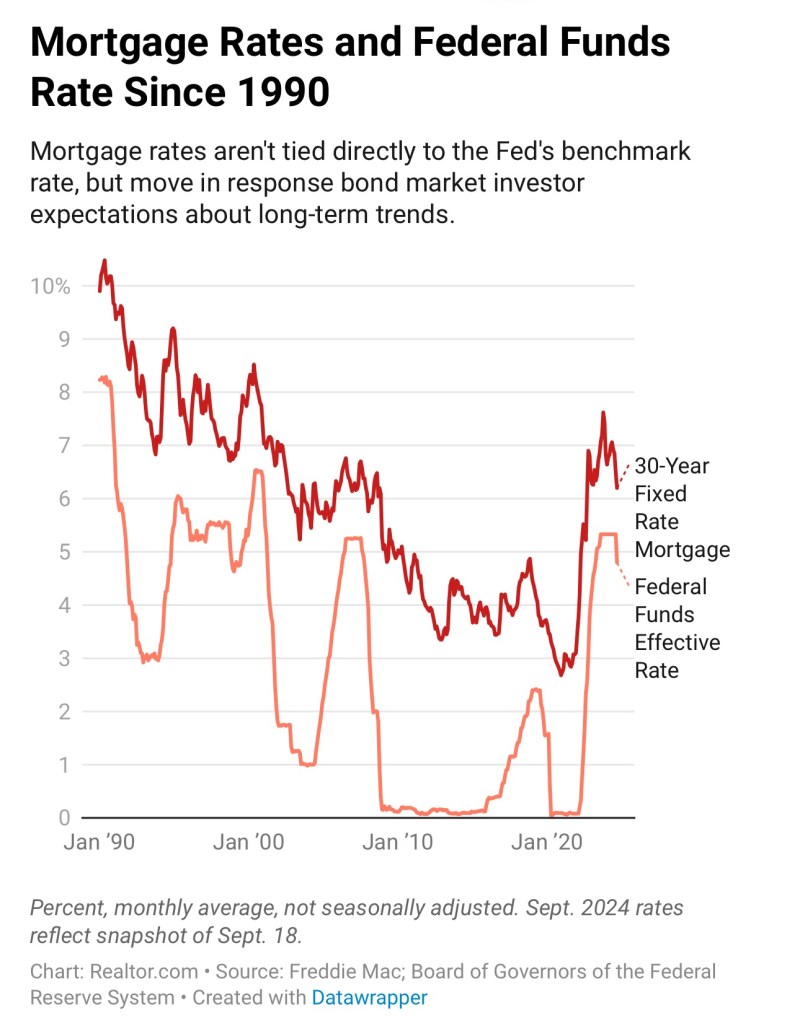

While mortgage rates are not directly tied to the federal funds rate, they do follow long-term trends in the bond market influenced by investor expectations of future Fed actions. The average rate on 30-year fixed mortgages has already dropped to 6.2% for the week ending September 12, down from 7.2% in May and a 23-year high of 7.9% in October.

Realtor.com® Chief Economist Danielle Hale notes that these lower rates have provided much-needed relief to homebuyer purchasing power, even though home sales remain sluggish. Monthly mortgage costs for the median-priced home have decreased to approximately $2,100, down from $2,400 in May 2024 and a peak of $2,440 in October 2023. This translates to an additional $70,000 in home purchasing power for buyers, with even greater boosts in high-cost markets like California.

Potential Market Shifts

Lower mortgage rates could also lead to an increase in housing inventory. Homeowners who have been reluctant to sell due to being “locked in” to older, lower rates may now consider entering the market. This increase in supply would be welcome news for buyers struggling with high prices and limited options.

Bright MLS Chief Economist Lisa Sturtevant suggests that a drop in borrowing costs will fuel more homebuyer demand and bring more sellers into the market, potentially leading to steady home prices in most local markets.

Future Rate Cuts and Market Expectations

National Association of Realtors® Chief Economist Lawrence Yun believes that further Fed rate cuts are already factored into current mortgage rates, which may not fall much further. He anticipates six to eight more rounds of rate cuts extending into 2025.

Fed Chair Jerome Powell, however, declined to speculate on future mortgage rate movements, emphasizing the complexity of predicting such trends.

Conclusion

The Fed’s aggressive rate cut marks a significant shift in monetary policy, with far-reaching implications for the housing market. As borrowing costs decrease, potential homebuyers and sellers should stay informed and consider how these changes might impact their financial decisions.

Stay tuned for more updates as the Fed continues its anticipated easing path and its effects on the economy unfold.

Leave a comment