San Francisco is on the brink of a significant shift in its housing market. The city is poised to extend rent control to thousands more renters, contingent on the outcome of California’s Proposition 33 this November.

Sweeping Changes on the Horizon

Board of Supervisors President Aaron Peskin has introduced an ordinance to expand rent control to multifamily buildings constructed between 1979 and 2024. This move could be the largest expansion of rent control since the 1970s, potentially covering 40% of renters currently unprotected due to the 1995 Costa-Hawkins Act. However, this measure will only take effect if Prop 33, which aims to repeal Costa-Hawkins, is approved by voters.

Economic Concerns and Developer Reactions

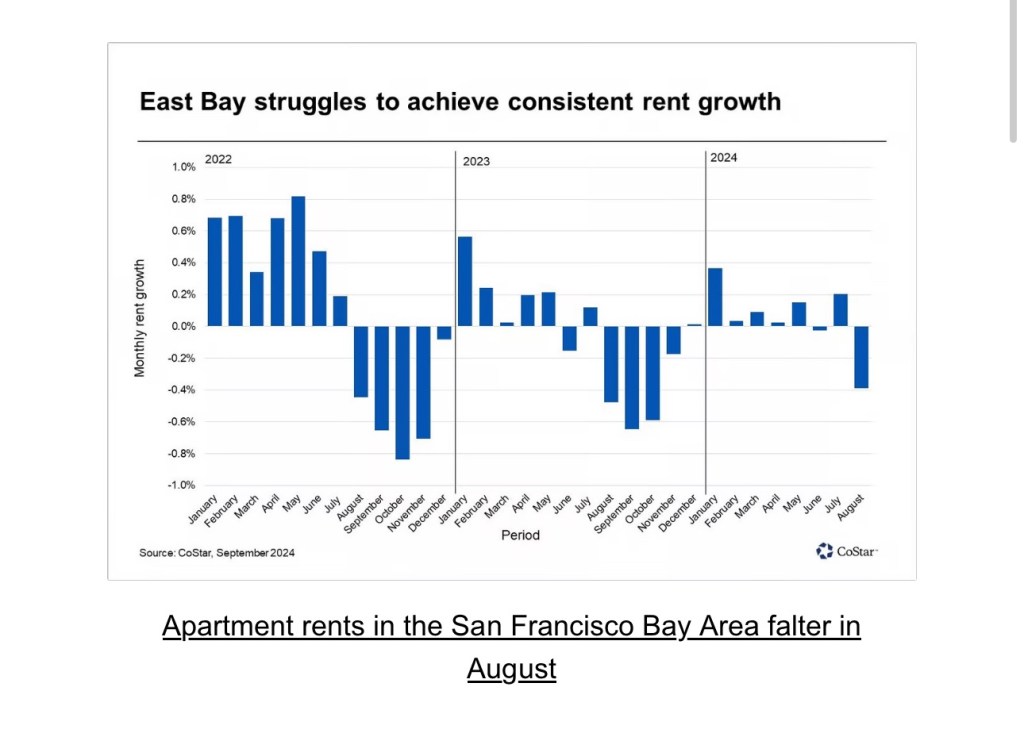

Developers are raising alarms about the potential freeze on new housing developments. With San Francisco facing a state mandate to approve 82,000 new housing units by 2031, the expansion of rent control could stymie critical growth. Rents have already dropped by 17% since 2019, and inflation continues to drive up costs. Critics, including developer Oz Erickson, warn that extending rent control could further depress investment in the city’s housing market.

The Tight Race for Prop 33

Statewide polling reveals a tight race for Prop 33. A UC Berkeley survey shows 40% of voters support the measure, 34% oppose it, and 26% remain undecided. The proposition faces strong opposition from landlord groups like the California Apartment Association, which labels it “extreme” for potentially allowing cities to enact vacancy controls. Similar measures were rejected by California voters in 2018 and 2020.

The Big Picture

The debate over San Francisco’s rent control expansion highlights a critical issue for investors and developers that could reshape the housing market. As Jay Parson notes, “Supply risk is predictable and temporary, but policy risk can be unpredictable and permanent.” Proposition 33 could destabilize the housing market, much like the experience in St. Paul, where one election cycle drove away developers. Ultimately, policy risks often shrink the housing supply, harming renters in the long run.

Stay tuned as we approach the November vote, which could significantly impact San Francisco’s real estate landscape.

What are your thoughts on this potential expansion of rent control? How do you think it will affect your investments and development plans? Share your insights in the comments below!

Leave a comment