As we move into September, the multifamily market is on the edge of its seat, eagerly anticipating the Federal Reserve’s decision to cut interest rates. August saw a steady performance in the sector, but the potential rate cut brings a mix of hope and caution.

Key Highlights:

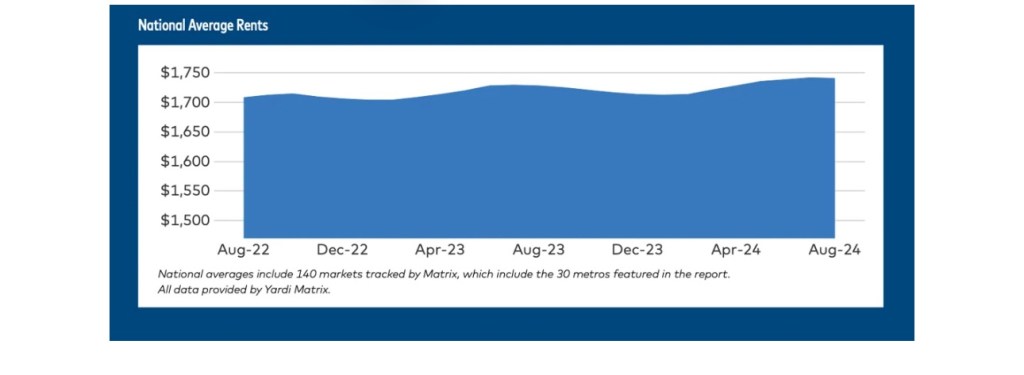

- Stable Performance in August: The multifamily market maintained its stability in August, with occupancy rates and rent growth showing minimal fluctuations.

- Anticipated Rate Cuts: The market is hopeful that lower interest rates will break the current logjam in transactions and spur refinancing activity. This could provide much-needed liquidity and opportunities for investors and property owners.

- Economic Implications: While lower rates are generally positive for the market, they also signal a slower-growing economy. This dual impact requires careful navigation by stakeholders.

Regional Insights:

- Midwest and Northeast: These regions have shown the highest rent growth, indicating strong demand and resilience.

- Austin’s Decline: In contrast, Austin has experienced significant declines, highlighting the varied performance across different markets.

Looking Ahead:

The upcoming rate cut decision is poised to have a significant impact on the multifamily sector. Lower rates could unlock new opportunities, but the broader economic implications must be considered. Stakeholders should stay informed and be prepared to adapt to the changing landscape.

Join the Conversation:

What are your thoughts on the potential impact of the September rate cut on the multifamily market? Are you seeing similar trends in your region? Share your insights and let’s discuss the future of the market!

For more detailed insights, check out the full report here.

Leave a comment