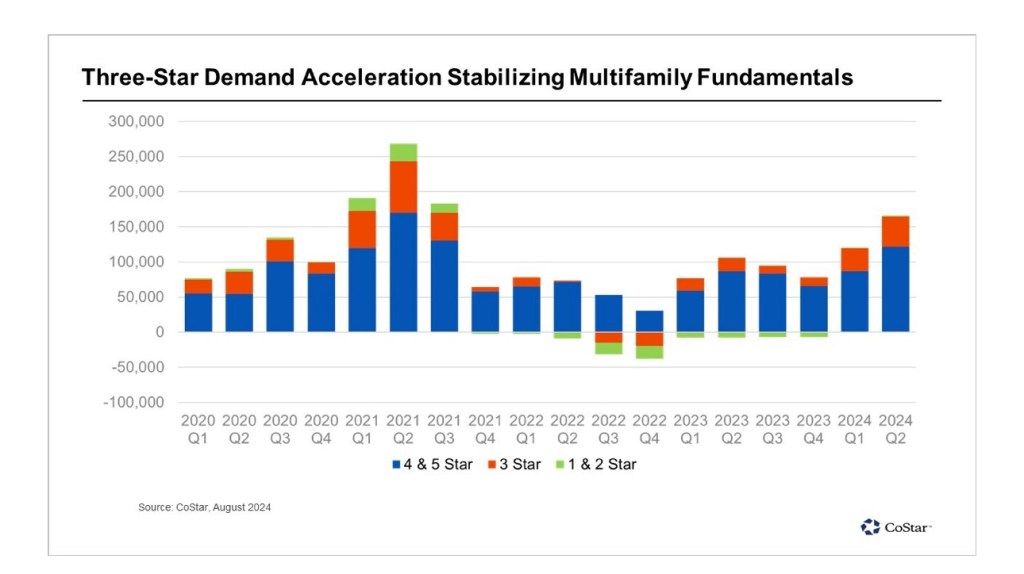

Demand for mid-priced, three-star-rated apartments has surged in 2024, with absorption already exceeding last year’s total. According to CoStar, demand for mid-priced, 3-star apartments shot up 86% year-over-year in Q1 2024 and surged 126% from Q2 2023.

Key Metrics:

- Vacancy Rates: Stabilized at 7.1% for 3-star units.

- Rent Growth: Steady at 1.6% for this segment.

- Absorption: Reached 75.8K units in the first half of 2024, surpassing the full-year 2023 total of 60K units.

Regional Highlights: Sun Belt markets dominated the top 15, while Northeast regions like NYC and Philadelphia also saw strong demand from young renters. Nationally, demand for mid-priced apartments—specifically those rated three stars or above—has dramatically accelerated in 2024.

By The Numbers:

- Absorbed Units: 75.8K in 1H24, an 86% jump in demand compared to Q1 2023 and 126% higher than Q2 2023.

- Luxury Apartments: Still hold the highest absolute demand with 121K units absorbed in Q2 2024, but mid-priced units are outpacing premium properties in growth rate.

Multifamily Rebound: The surge in demand for mid-priced rentals marks a significant turnaround from 2022 when 3-star-rated properties saw negative absorption of 20K units. Rising inflation, recession fears, and low consumer sentiment deterred household formation, especially among younger renters.

In contrast, 2024’s improving economic conditions, including an anticipated September Federal Reserve interest rate cut, have reassured many prospective renters. This has unleashed pent-up demand for housing, particularly among younger adults moving out to secure their first rentals, positioning 3-star apartments as the go-to option.

Stabilizing Numbers: The influx of demand has stabilized vacancy rates for 3-star apartments, holding steady at 7.1% between Q1 and Q2. This also marks the end of a 10-quarter trend of rising vacancy rates for these units. Rent growth for this market segment remained modest but steady at 1.6%, reflecting balanced supply and demand dynamics.

Regional Trends: While the Sun Belt continues to dominate apartment demand, accounting for 7 of the top 15 markets in 2024, several Northeast cities—including NYC, Philadelphia, and DC—are also seeing robust 3-star unit absorption. Overall, 3-star-rated properties are outperforming the overall market in many regions. Indeed, in 14 of the top 15 markets, vacancy rates for mid-priced apartment units are lower than the overall market average, while rent growth is stronger in 10 of those markets, indicating sustained demand for affordable housing options.

What are your thoughts on the surge in demand for mid-priced apartments? Share your insights in the comments below!

Leave a comment