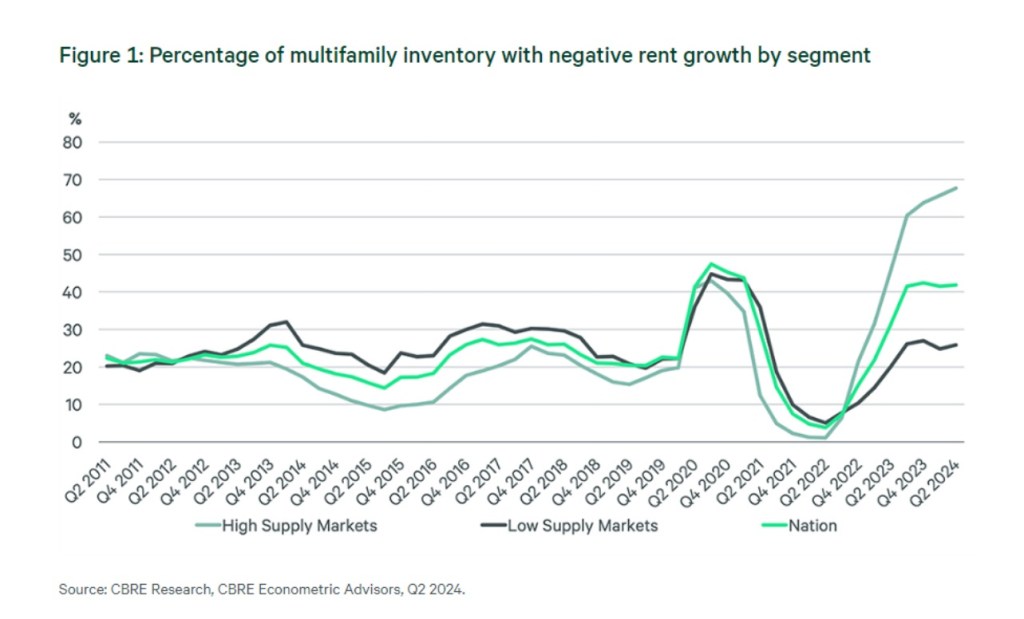

High-supply multifamily markets are beginning to stabilize as renter demand absorbs new units, leading to improved occupancy rates. In Q2, nearly 70% of inventory in these markets experienced negative rent growth. However, this trend is expected to reverse as demand outpaces new supply.

- Occupancy Rates: According to CBRE Research, occupancy rates are stabilizing as demand absorbs much of the new supply. Several high-supply markets are expected to see positive rent growth soon.

- Rent Growth: In Q2, nearly 70% of inventory in high-supply markets reported negative rent growth, compared to only 26% in low-supply areas. Despite this, about 33% of inventory in the hardest-hit regions maintained positive rent growth, showing resilience.

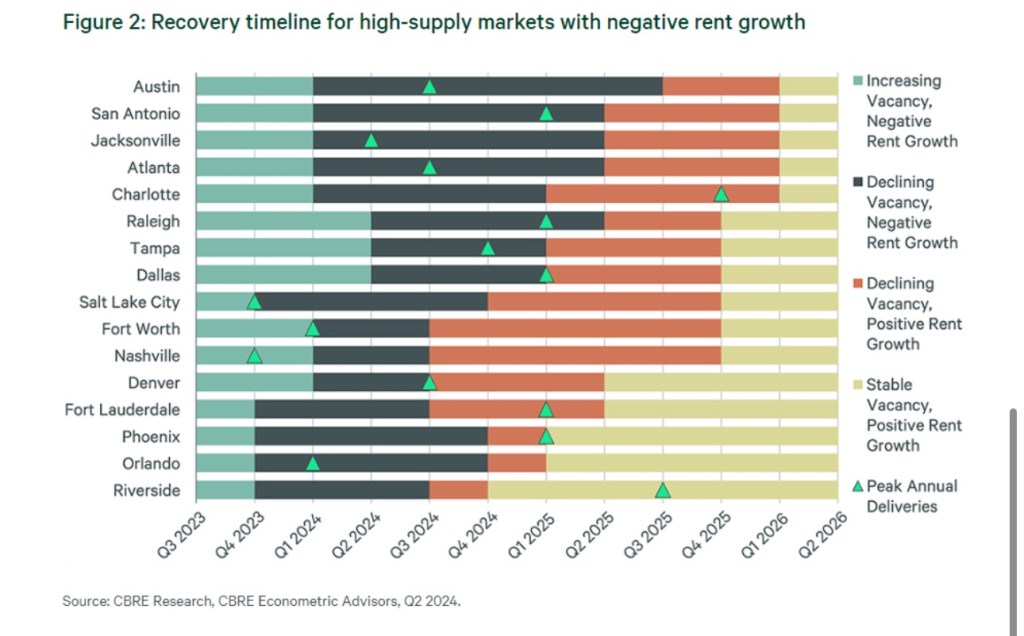

- Regional Variations: Major Sun Belt and Mountain markets, which saw significant new construction during the pandemic, experienced the most substantial rent cuts. However, markets like downtown Atlanta, Austin, Orlando, and Phoenix are showing steady signs of recovery. By mid-2025, most high-supply markets are expected to enjoy stable vacancy rates and positive rent growth. Austin, however, may take longer to recover due to a surge in suburban development, with rent recovery likely delayed until Q3 2025.

Multifamily property values appear to have stabilized, with capitalization rates expected to decline once the Federal Reserve cuts interest rates starting in September. As occupancy rates improve and rent growth resumes, apartment values will rise, setting the stage for a recovery beginning in high-supply markets.

While high-supply multifamily markets have faced significant challenges in recent quarters, the outlook is improving as demand begins to exceed pandemic-driven supply. Most major multifamily markets should see positive rent growth and stable vacancy rates by mid-2025, with slight exceptions in laggards like Austin, which may take an additional quarter to recover.

Leave a comment