After a prolonged post-pandemic hiring frenzy, the U.S. labor market is showing signs of cooling. In July, employers added just 114,000 new jobs, significantly fewer than economists had anticipated. The unemployment rate also spiked to 4.3%, the highest level since 2021. Adding to the concerns, the Labor Department recently revised its data, revealing that the U.S. added 818,000 fewer jobs than initially reported for the year ending in March. While hourly wages have outpaced inflation since the pandemic, Americans are increasingly seeking higher pay to keep up with rising living costs. This weaker job market is one reason traders are confident that the Federal Reserve will cut rates this month.

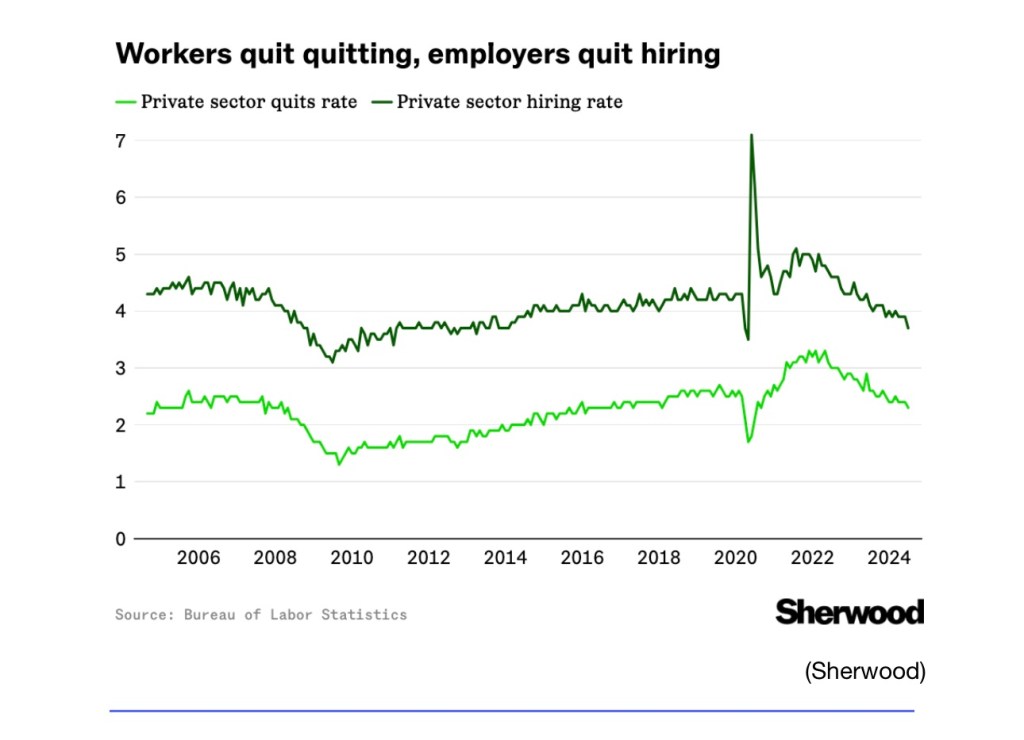

Following mass layoffs last year, job cuts have once again made headlines in 2024. Major companies like Microsoft, Google, Nike, and IBM have all reduced their workforce, exacerbating a slowdown in white-collar jobs. The gaming industry has also been hit hard, with companies like Take-Two, EA, and Epic laying off more employees this year than in 2023 and 2022 combined. Meanwhile, job hoppers are experiencing smaller pay increases compared to two summers ago, when a plethora of open positions gave candidates the upper hand. Now, more workers are staying put, with quit rates and hiring rates falling below pre-pandemic levels.

The slowdown has made it increasingly difficult for new graduates to secure entry-level positions. Hiring projections for the class of 2024 are down approximately 6% from last year. At the same time, many baby boomers are coming out of retirement, adding to the competition for jobs.

Looking Ahead

The weakening job market has sparked fears of a potential recession. However, there are some positive signs: jobless claims dipped last week, and the U.S. economy grew faster in Q2 than initially reported, raising hopes for a soft landing. Additionally, the Federal Reserve’s expected rate cuts could help revive hiring. At the Jackson Hole symposium last month, Fed Chair Jerome Powell stated, “We do not seek or welcome further cooling in labor market conditions.”

Leave a comment