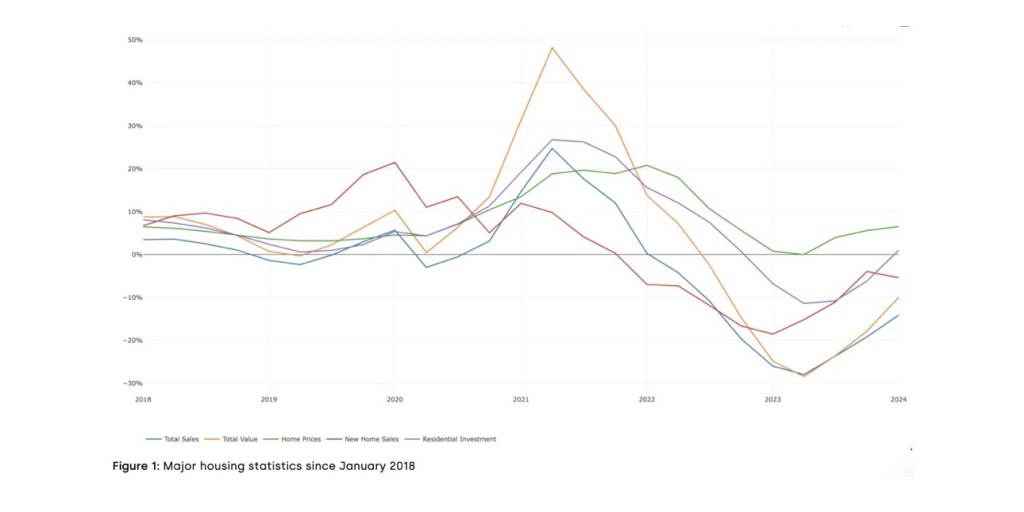

In a surprising twist, the historical link between housing downturns and recessions appears to be weakening. Despite a significant decline in home sales and residential investment in 2023, the broader U.S. economy remains resilient. Unemployment rates are low, and GDP growth is strong, defying traditional economic predictions.

Decoupling Housing from the Economy

Several factors may be contributing to this shift. Stringent land use requirements and the prevalence of low fixed-rate mortgages are playing a crucial role in decoupling housing from the broader economy. These elements are creating a buffer that prevents the housing market’s struggles from spilling over into a full-blown recession.

Challenging Traditional Views

This shift challenges the long-held view of housing as a reliable recession indicator. Economists and investors alike are finding it increasingly difficult to use housing market trends to predict broader economic downturns. The decoupling complicates economic predictions and calls for a reevaluation of traditional economic models.

What Does This Mean for the Future?

As we move forward, it’s essential to monitor these trends closely. The resilience of the U.S. economy amidst a housing downturn could signal a new era in economic forecasting. Understanding the factors at play will be crucial for making informed investment decisions and anticipating future economic shifts.

Stay tuned as we continue to explore these evolving dynamics and what they mean for the real estate market and the broader economy.

Feel free to share your thoughts or ask questions in the comments below. Let’s engage in a meaningful discussion about this intriguing shift in economic trends!

#RealEstate #Economy #HousingMarket #CoreLogic #EconomicTrends #Investment

Leave a comment