A Tale of Two Markets

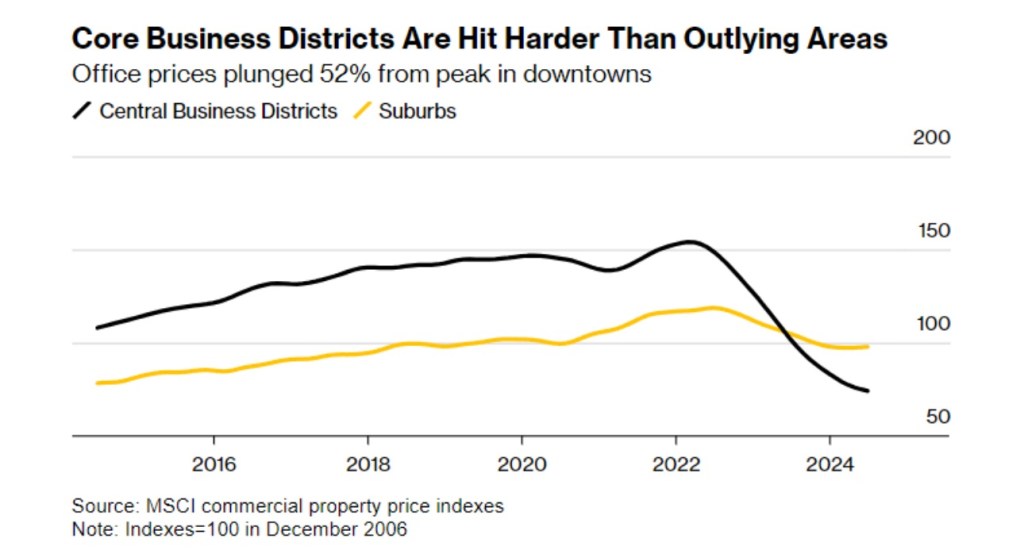

The U.S. commercial real estate (CRE) market is experiencing a significant divide. Central business districts are grappling with plummeting office values, while suburban and high-demand neighborhoods are thriving. From 2019 to 2023, U.S. office values have dropped by a staggering $557 billion, with central business districts suffering the most, seeing a 52% decline.

Urban Struggles vs. Suburban Success

Central business districts, once bustling with activity, are now facing vacancies and declining property values. For instance, downtown Los Angeles’ largest commercial landlord, Brookfield Corp., recently defaulted on $2.2 billion in mortgages, highlighting the challenges these areas face.

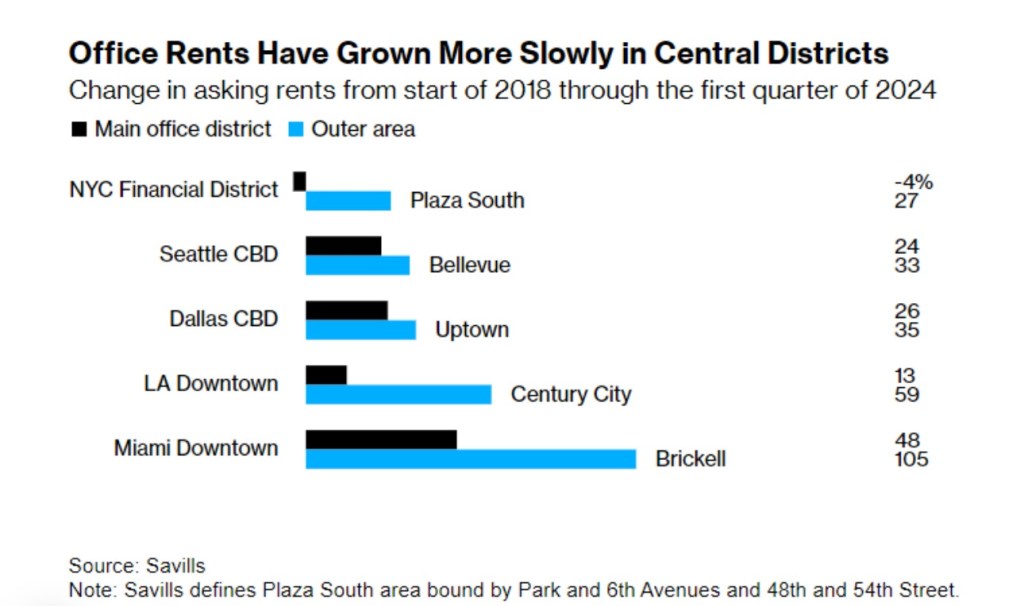

In contrast, suburban areas and high-demand neighborhoods like LA’s Century City are booming. Century City, known for its prestigious Avenue of the Stars, is attracting significant investment. A new 37-story tower is under construction, set to house major tenants like Creative Artists Agency (CAA) and Sidley Austin. These trophy properties command rents up to 84% higher than older downtown buildings, according to CBRE Group Inc.

The Flight to Quality

This growing divide is driven by a “flight to quality.” Companies are willing to pay a premium for newer buildings in safe, amenity-rich neighborhoods that offer better access to parks, shopping, restaurants, and entertainment. As a result, areas like Century City in LA and the West Loop in Chicago are attracting more tenants, while older downtown properties struggle to compete.

In Chicago, the East Loop, once a bustling business center, is now grappling with record vacancies. Meanwhile, the West Loop, home to newer buildings and top-tier amenities, continues to attract companies. BMO Financial Group recently relocated its Chicago headquarters to the West Loop, leaving behind older downtown office buildings now part of a redevelopment project.

Transforming Downtowns

While traditional central business districts are losing office tenants, they are finding new life in other ways. Some cities are reimagining downtown areas for residential developments and educational institutions. Arizona State University and the University of California at LA are revitalizing old downtown buildings, bringing students and creative industries into the area.

The rise of outlier areas is also impacting industries traditionally centered in downtown cores. The entertainment industry’s migration to Century City is bringing law firms and financial services along for the ride. Major firms like Skadden, Arps, Slate, Meagher & Flom, and Sidley Austin are reducing their downtown presence in favor of Century City, further accelerating the shift away from central business districts.

The U.S. office market is undergoing a profound transformation. As central business districts struggle, suburban and high-demand neighborhoods are thriving, attracting investment and offering premium spaces. This shift presents both challenges and opportunities for investors and businesses navigating the evolving landscape of commercial real estate.

Leave a comment