Homebuyers rejoice.

Inflation, that ever-watchful economic indicator, has finally eased its grip. For the first time since March 2021, annual inflation in the U.S. has dipped below 3%, according to data released by the Department of Labor. This news brings a glimmer of hope to prospective homebuyers, signaling potential relief in the form of lower mortgage rates.

The Numbers

- Annual Inflation: Over the 12 months through July, the consumer price index rose by a modest 2.9%. While still above the Federal Reserve’s 2% target, this marks a significant cooling from previous months.

- Monthly Trends: In July, overall prices ticked up by 0.2% compared to June. The driving force behind this increase? Housing costs, which are reported on a delayed basis. Energy costs remained flat, while food prices rose modestly.

- Mortgage Rates: The overall cooling of inflation bodes well for mortgage rates. Already, rates have fallen in recent weeks. Analysts predict that the central bank is extremely likely to cut its current benchmark rate of 5.3% when policymakers convene in September.

Market Impact

Ralph McLaughlin, senior economist at Realtor.com®, emphasizes the positive outlook: “Today’s data reassures markets that rate cuts are on the horizon. This fall and winter could set the stage for a much better season for homebuyers in 2025.” Mortgage rates hit their lowest level in over a year, with the average 30-year fixed rate dropping to 6.47%, according to Freddie Mac.

The Shelter Quirk

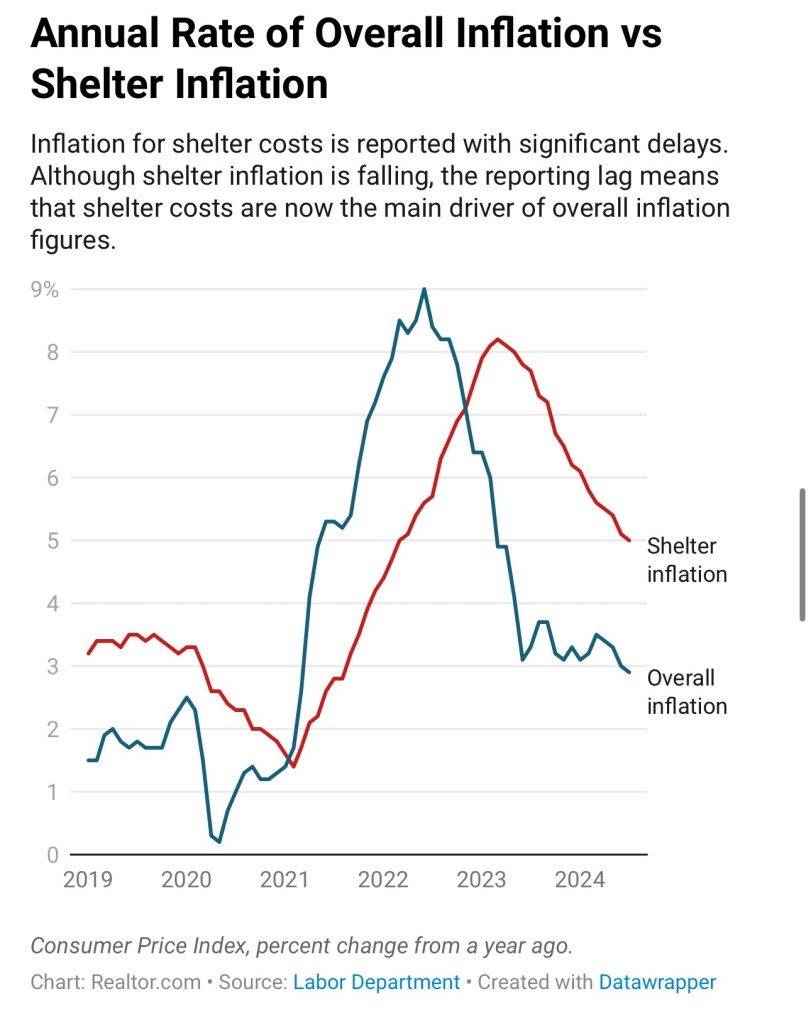

While housing costs play a pivotal role in inflation figures, there’s a catch. Shelter costs—accounting for more than a third of the consumer price index—are reported on a delayed basis. These costs reflect the estimated rent for homeowners’ primary residences. However, they may primarily capture changes in rental markets from up to six months ago, rather than real-time homeowner expenses.

McLaughlin explains, “Shelter inflation lags behind real-time housing market shifts. As the shelter pig works its way through the CPI python, we’ll continue to get better readings through the remainder of the year.”

Fed’s Dilemma

Some economists argue that the way housing costs are calculated artificially boosts inflation figures. Could the Fed be too late in responding? Bright MLS Chief Economist Lisa Sturtevant points out, “Higher rates have exacerbated housing costs by dampening new construction and increasing borrowing costs.” With housing costs removed from the index, the CPI has averaged just 1.7% since May 2023.

In the end, even with rate cuts and declining mortgage rates, some homebuyers remain cautious. But the tide may be turning, and the housing market awaits its next chapter.

Leave a comment