Introduction

In the ever-evolving landscape of U.S. office markets, sky-high leases have emerged as a powerful force. These premium leases not only outperform other leasing activities but, in some cases, yield higher effective rents than pre-COVID levels. Let’s explore this trend and its implications.

The Flight to Quality

Higher Floors, Higher Appeal

Today’s office tenants exhibit a clear preference for higher floors. While this is just one aspect of the broader “flight to quality” story, it plays a crucial role. The data underscores the significance of this trend.

Comparing Major Cities

New York Takes the Lead

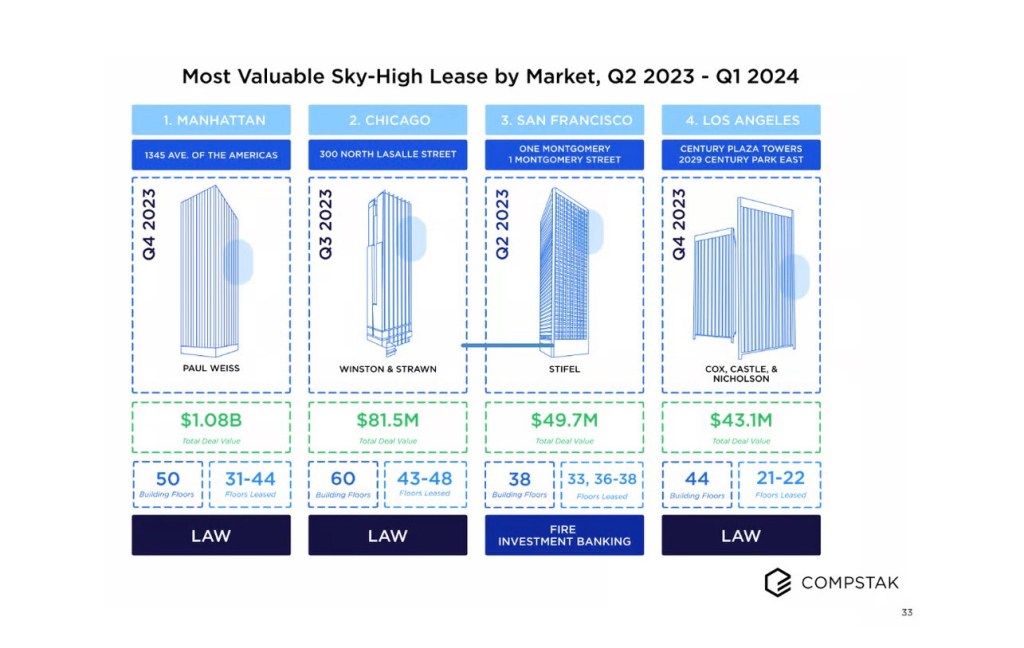

From Q2 2023 to Q1 2024, New York led the pack in sky-high deals among major U.S. cities. Its top five transactions ranged from $187 million to over $1 billion, reflecting robust demand for premium office spaces.

Dominance of Legal and Financial Industries

Across all four markets, the legal and financial sectors dominated recent sky-high deals. These industries, known for paying top rents, secured prime spots in prestigious sky-high buildings.

Conclusion

Sky-high leases are reshaping the post-COVID office market. As tenants seek quality and prestige, investors and professionals must adapt to this dynamic landscape.

Leave a comment