Despite assumptions that smaller banks bear the brunt of commercial real estate woes, it’s the big players feeling the heat.

Loan Exposure

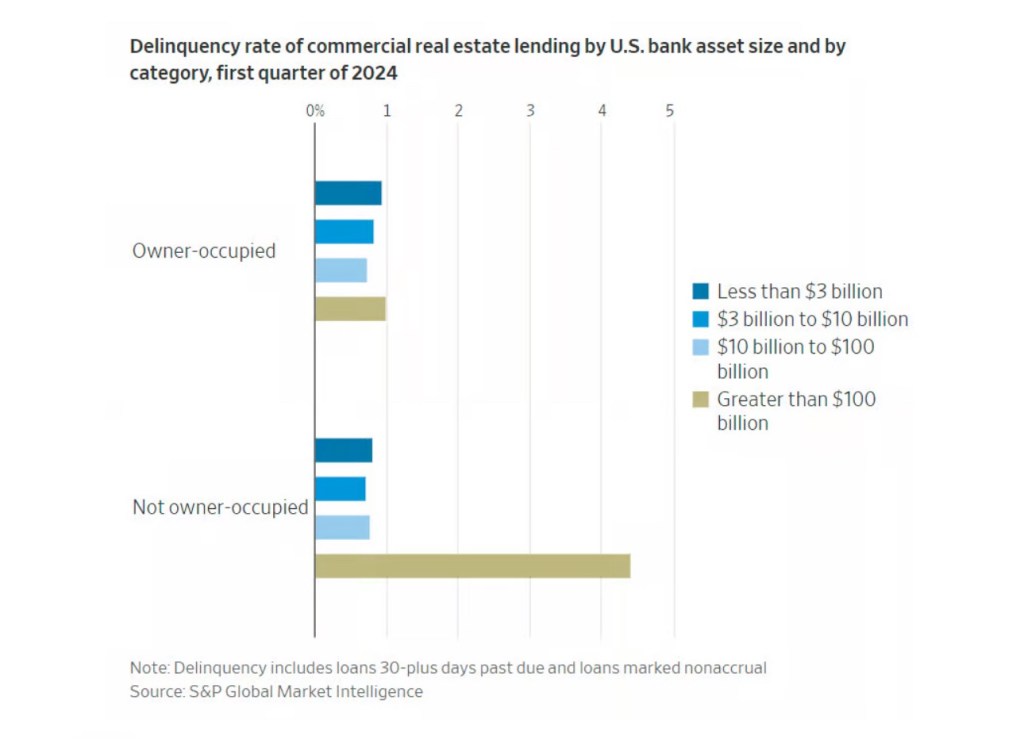

While smaller banks hold a significant share of CRE and multifamily property debt in the U.S., the top 25 largest banks are grappling with more loan delinquencies. Not all CRE loans are created equal—factors like loan purpose and property type come into play.

Delinquency Disparities

Data from S&P Global Market Intelligence reveals that loans for leased properties (non-owner-occupied) held by banks with over $100 billion in assets have higher delinquency rates. In Q1, over 4.4% of these loans were delinquent or in nonaccrual status, compared to less than 1% for smaller banks and owner-occupied loans. The culprit? Interest rates.

City vs. Suburb

Geography matters too. While big banks aren’t the sole lenders downtown, they face more immediate maturities. National banks held 29% of maturing office debt last year, while regional banks held 16%. Balloon payments loom large, forcing closer assessment of repayment risks.

The Takeaway

Big banks grapple with a 1.1% net charge-off rate for non-owner-occupied CRE loans in Q1—higher than smaller banks. As the property market shifts, smaller banks may face their own challenges. But if interest rates remain high amid economic stability, hidden value could emerge. 🏢📊💡

Learn more at: www.danielkaufmanrealestate.com

Leave a comment