In-Depth Analysis Reveals Conservative Underwriting Amid Rate Hikes

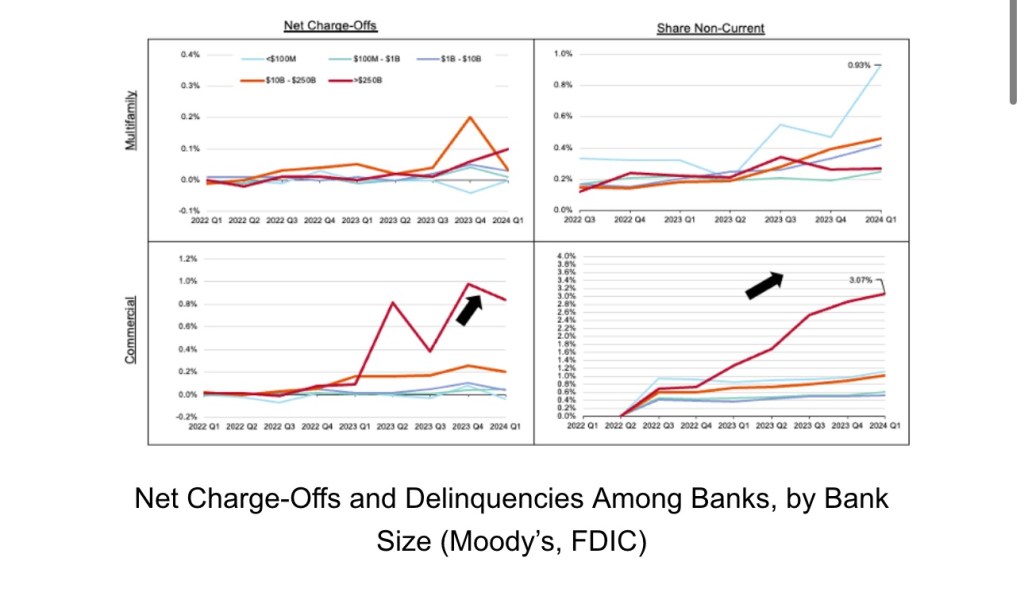

Moody’s Ratings recently conducted an extensive review of credit metrics across 41 US commercial banks. Their findings? Most bank loans are conservatively underwritten, despite the significant interest rate hikes since 2022.

Context Matters

Delinquency rates for bank commercial real estate (CRE) loans have remained relatively mild this year. US banks currently hold approximately 38% of the staggering $4.7 trillion in outstanding CRE loans. Surprisingly, community banks have increased their CRE loans by $40 billion (9%) over the past year.

Balancing Act

The gradual rise in delinquent bank CRE loans is partly influenced by the Federal Reserve’s hawkish stance, maintaining a target rate of 5.25–5.50% at their latest meeting. Meanwhile, the Core Consumer Price Index (CPI) stood at 3.3% on June 21, below last year’s 5.3%. The Fed faces the delicate task of managing inflation versus financial market stress.

Resilience Amid Maturing Loans

Despite $440 billion in maturing CRE loans year-to-date, the US banking system remains resilient. Anticipated maturities of over $900 billion by year-end 2024 underscore the sector’s stability. Average commercial bank loan-to-value ratios hover around 66–67%, providing ample reserves to weather challenges like loan defaults and refinancing issues.

Office Sector Concerns

Not all sectors thrive. Moody’s highlights that approximately 70% of bank office loans are expected to default at maturity. Rising interest rates compound this impending issue, potentially posing challenges for banks.

Optimism prevails in the US CRE market during 2Q24. Positive deal volumes in large multifamily, industrial, and non-mall retail sectors signal a gradual recovery in lending activity. However, with most CRE loans maturing by the end of 2025, banks must tread carefully with their office loans. 🏢💼📈

Disclaimer: The information provided in this article is based on Moody’s analysis and publicly available data. It does not constitute financial advice. Always consult a professional before making investment decisions.

Leave a comment