The build-to-rent (BTR) industry has surged as the fastest-growing segment of single-family home construction. With mortgage rates surpassing 6.5%, limited housing supply, and sustained demand, new homebuyers need six-figure incomes to afford median-priced houses. Here’s what you need to know:

Key Findings:

- BTR Home Starts: Fixr.com estimates 112,920 BTR home starts nationwide in 2023—a 102% increase since 2019.

- Affordability Drives Demand: 71% of experts attribute BTR growth to home affordability.

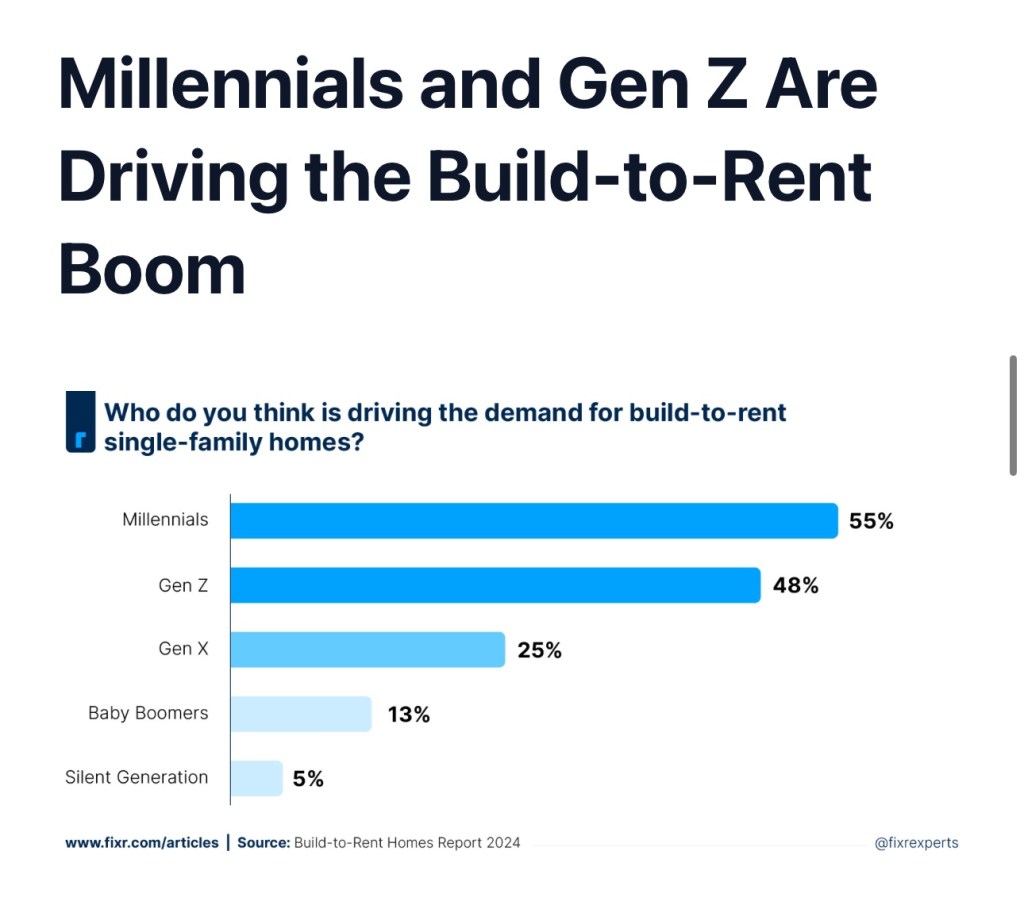

- Generational Impact: Millennials (55%) and Gen Z (48%) are key drivers of BTR demand.

Build-to-Rent Construction Rate

An analysis of U.S. Census data reveals 75,000 BTR starts in 2023. However, this doesn’t account for the 4% sold for renting purposes. Fixr.com predicts an additional 37,920 units, resulting in 112,920 BTR home starts. Financing challenges may explain the 5% decrease from 2022.

Home Affordability Matters

76.9% of U.S. households can’t afford a median-priced home at 6.5% interest. Renting remains cheaper, but cost-burdened renters (12 million households) spend over 50% of their income on housing.

Real Estate Investment Boosts BTR

36% of experts cite real estate investment as a reason for BTR growth. Builders now sell to property management companies, expanding the market.

Generational Trends

Millennials (55%) and Gen Z (47.5%) drive BTR demand. As affordability challenges persist, BTR offers a viable housing solution.

Source: Fixr.com, Bankrate, NAHB, Harvard University’s Joint Center for Housing Studies

Leave a comment