A robust economy and surging demand fuel multifamily fundamentals, but hurdles loom. Our deep dive into Yardi Matrix’s Mid-Year Outlook reveals insights:

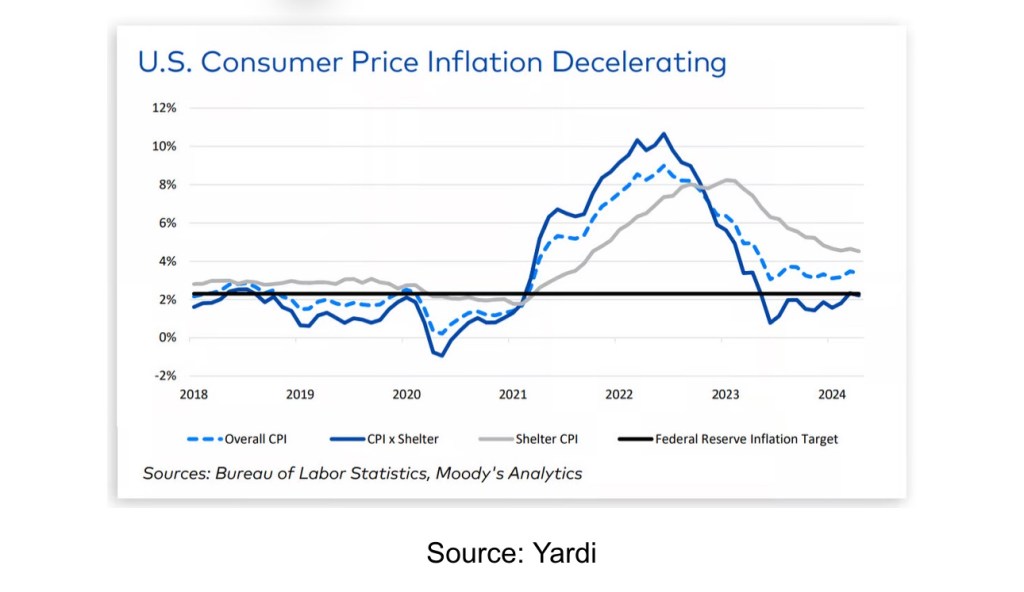

- Economic Resilience: GDP growth (1.3% in Q1 2024) and employment gains signal recovery. Yet inflation and income disparities persist.

- Rent Growth: Modest national rent increase (1.7%) masks regional variations. Midwest and Northeast thrive; Sun Belt faces supply pressure.

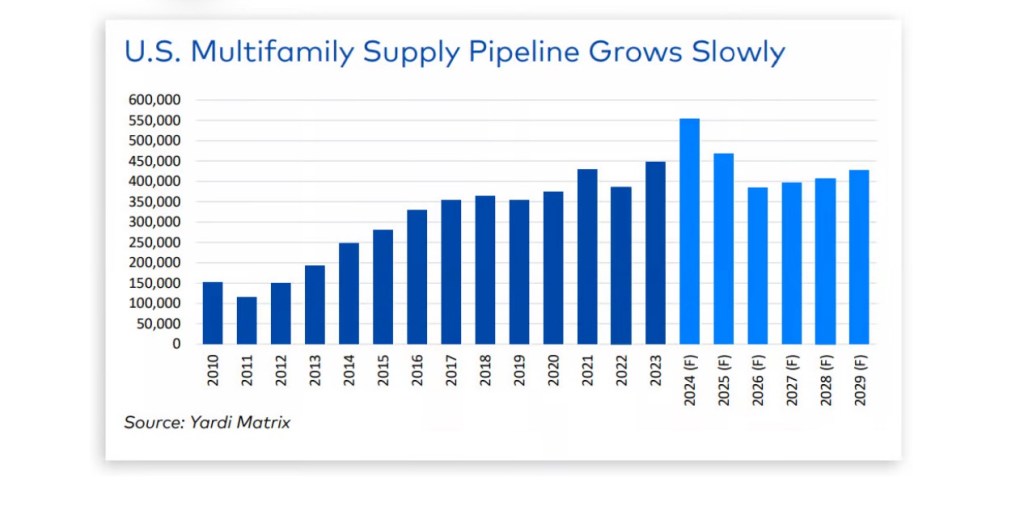

- Supply Surge: Record 553,000 units expected in 2024, led by Dallas-Fort Worth, Austin, and Phoenix. Financing costs temper construction.

- Transaction Trends: $19.3 billion in multifamily deals (down 24%) as sellers await better rates. Mortgage rates range from 5.5% to 7%.

- Debt Landscape: Non-current loan rates at 0.3%. Smaller banks cautious; debt sources remain abundant.

- GSEs and Debt Funds: Fannie Mae, Freddie Mac focus on green deals; debt funds fill financing gaps.

- CMBS Rebound: Issuance up 154% YoY, reaching $33.6 billion by May 2024.

🔍 Waiting Game: Rent growth and occupancy dip post-2022 peak. High rates challenge markets; Fed treads carefully. What’s your take? 🤔 #RealEstate #InvestmentInsights

Leave a comment