In the dynamic world of real estate, a fascinating trend is emerging. The Northeast’s housing market is ablaze with activity, while Florida’s once-boiling market is showing signs of a cool-down. A recent study by John Burns Research and Consulting (JBREC) sheds light on this intriguing development.

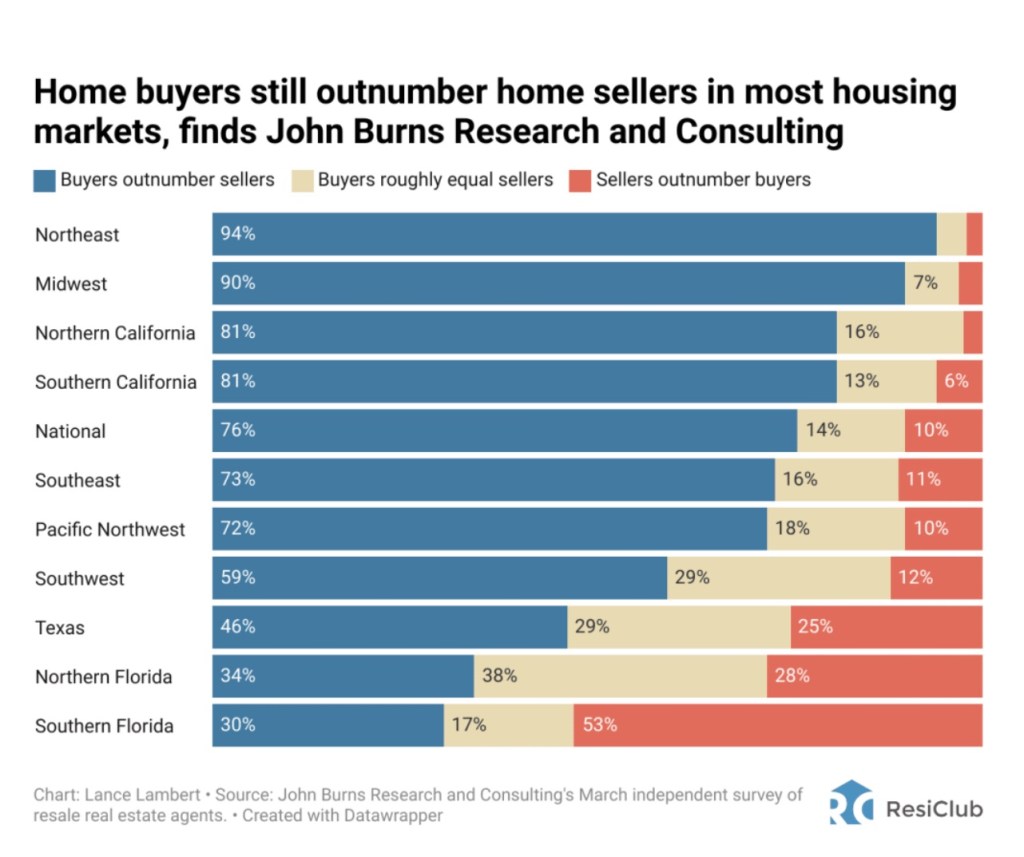

The JBREC’s March survey of real estate agents confirms what the inventory data has been whispering for months: Florida and Texas are experiencing a market relaxation, with active listings nearing the pre-pandemic era. Contrastingly, the Northeast, Midwest, and Southern California are locked in a fierce battle for available homes.

A staggering 94% of Northeastern resale agents report a market dominated by buyers, a stark contrast to South Florida’s mere 30%. The question on everyone’s lips: What’s happening in the Sunshine and Lone Star states?

Florida’s housing inventory has surged by 57% year-over-year, the most significant national increase. However, this rise is predominantly in Southwest Florida, particularly in areas like Cape Coral and Fort Myers, which felt the wrath of Hurricane Ian in September 2022.

The hurricane’s legacy? A swath of damaged homes and a surge in renovations, leading to an unexpected spike in housing inventory. NOAA pegs Hurricane Ian’s destruction at a staggering $112.9 billion, ranking it as the third most expensive hurricane in U.S. history. The aftermath? A concoction of increased housing supply, sky-high home prices, mortgage rates, insurance premiums, and HOA fees, culminating in a market cooldown across Southwest Florida.

Texas tells a similar tale, with Austin’s home prices skyrocketing too quickly for local wallets. As the pandemic migration boom waned, Austin’s housing prices exceeded affordability, resulting in a market correction.

Let’s dive into this further. What are your thoughts on these market shifts? Have you noticed similar trends in your area? Share your experiences and join the conversation as we explore the ever-evolving landscape of American real estate.

Leave a comment