The U.S. housing market is currently experiencing a peculiar trend that echoes the prelude to the financial crisis of 2008. With home prices escalating rapidly, experts are debating whether this signals the inflation of another bubble.

Despite the dampening effect that high mortgage rates typically have on home buying, prices continue to soar. A recent report by ATTOM highlights a slight increase in the financial strain on U.S. homeowners at the start of this year compared to the end of 2023. This strain, coupled with the steep rise in home prices, raises concerns. However, the current situation seems to stem from a classic supply and demand mismatch rather than speculative frenzy.

The Federal Reserve’s interest rate hikes over the past two years, aimed at curbing inflation, would usually result in higher mortgage rates and lower home prices. Yet, the market has defied expectations with both mortgage rates and home prices climbing.

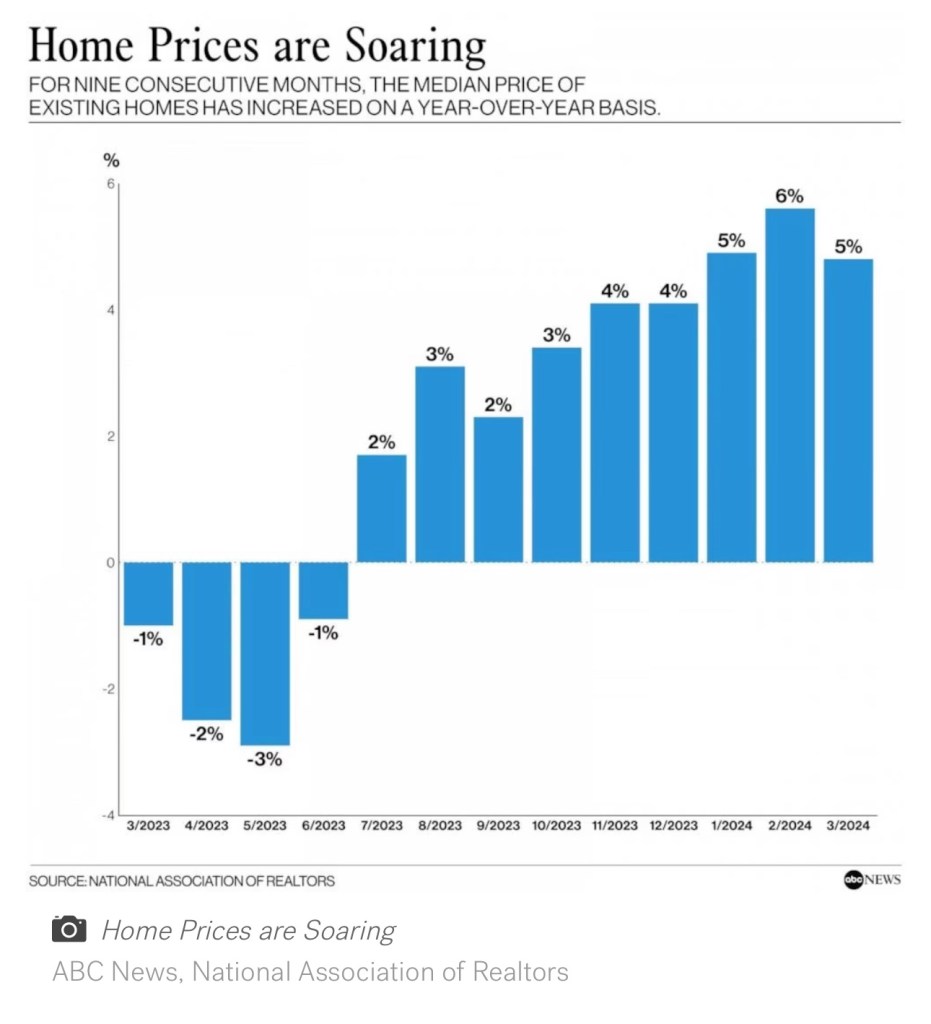

Data from the National Association of Realtors (NAR) reveals a consistent rise in existing-home prices for nine months straight, with a nearly 40% increase over the past four years. The pandemic-induced slowdown in homebuilding, due to material and labor shortages, has only exacerbated the situation. As supply blockages eased, the Fed’s rate hikes made borrowing more costly for developers, slowing down new projects.

The housing construction cooldown has led to a significant shortage, with a deficit of 3.2 million homes needed to satisfy demand, according to Hines. Christopher Mayer, a real estate professor at Columbia University, points out the obvious: “We haven’t built enough houses, and there’s still a lot of demand.”

This shortage starkly contrasts with the pre-Great Recession era, where a price surge led to excessive homebuilding and an eventual market crash. Today’s high prices, however, are buffered by the housing shortage, which limits how much they can fall. Ken Johnson, a real estate economist, doesn’t foresee a dramatic crash but anticipates a possible plateau or slight dip in home prices as they reach the upper bounds of affordability.

While Johnson warns of potential interest rate cuts that could further inflate the housing market, Yun suggests that a recession could lead to layoffs, affecting homeowners’ ability to pay mortgages and possibly increasing the supply of homes on the market. Yet, even in such a scenario, he predicts only a modest decline in home prices.

Norman, another expert, believes that while a bubble may not be imminent, the market could benefit from some deflation to address the growing issue of affordability. The market might not be heading towards a burst, but it could certainly use some relief from the ballooning prices.

Leave a comment