As we navigate through 2024, it’s crucial to understand the economic undercurrents molding the commercial real estate (CRE) landscape. Amidst a market seeking equilibrium, we delve into the potential trough and the ongoing dislocation affecting CRE.

The past three years have been a rollercoaster for the global economy. Injecting trillions into a functioning economy, while halting global supply chains, led to swift inflation and a historic rate hike cycle in the U.S. This resulted in unprecedented macroeconomic volatility.

Currently, equity markets are soaring, yet CRE is on a quest for stability. There’s a buzz around large institutional investors ready to invest significant capital in the coming years, hinting at a transient dislocation and a nearing trough for CRE.

Capital flow is a barometer of demand within finance, influencing everything from bonds to stocks. As demand for assets increases, so typically does their price, propelled by capital influx.

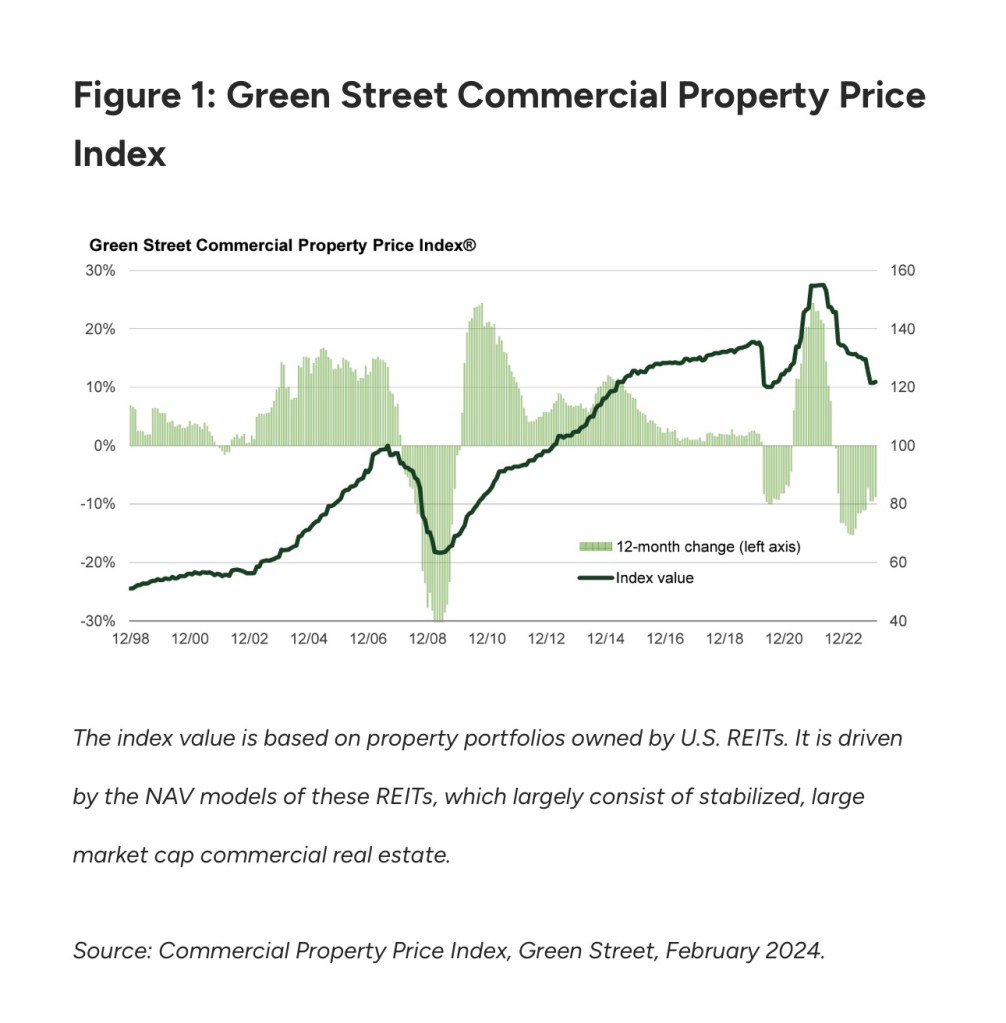

We’re tracing the capital trail to gauge the impact of capital flows over the last three years on CRE. The pandemic’s onset saw CRE retract, paralleling a 19.9% dip in U.S. equities. REITs’ NAV fell across the U.S. CRE market. However, as shown in GreenStreet’s index, the market rebounded, and CRE valuations surged alongside equities until mid-2022, benefiting from the “wealth effect” and a flush of cash in the economy.

The Federal Reserve’s rate hikes beginning in March 2022 shook the CRE sector. CBRE’s analysis suggests that a 100-basis-point hike in long-term interest rates can lead to a 60-basis-point increase in CRE capitalization rates, often resulting in value depreciation.

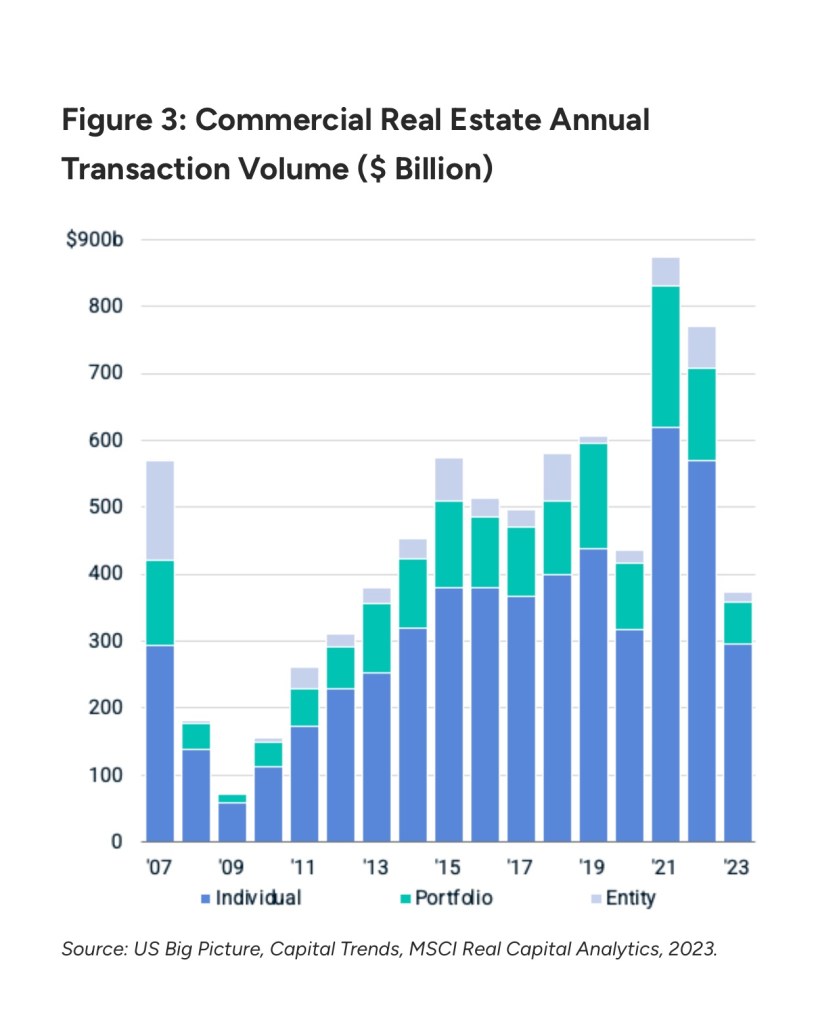

This shift became apparent in Q2 of 2022, with a market pullback and a drop in transaction volumes. Banks and lenders, facing interest rate exposure, retracted, especially as the office market faced distress. By spring 2023, a regional bank crisis, partly due to CRE exposures, led to a credit crunch, reducing lending capital and hiking borrowing costs.

As we continue to “follow the money,” we remain vigilant of the capital flows that will define the CRE market’s trajectory in 2024 and beyond. Stay tuned for more insights as we chart this journey through economic shifts and capital trends.

Deciphering the CRE Conundrum: A Blog Perspective

The U.S. commercial real estate (CRE) market has hit a transactional snag, but this is just one piece of a larger puzzle. On the equity front, a parallel narrative emerged. As long-term debt yields, particularly the 10-Year Treasury, ascended, so did the yield-on-cost benchmarks for CRE equity investors. The math simply didn’t add up for new deals. Despite the high demand and supply chain hiccups from the pandemic keeping construction costs aloft, Greenstreet’s index signaled asset valuations peaking. Strong fundamentals in sectors like industrial and multifamily persisted, yet the specter of recession cast doubt among investors, leading to a cautious stance.

The Post-Boom Dilemma for Property Owners

Property owners, having enjoyed a decade of appreciation thanks to low interest rates, now grapple with the new reality of costlier capital. Many opted to hunker down, managing their portfolios while aiming to “survive to ’25.” This wait-and-see approach led to negotiations with lenders for loan extensions or modifications, as foreclosing in a bearish market was the least desirable option for financial institutions.

This collective hesitancy significantly throttled transaction volumes, a vital sign of health in the typically illiquid CRE market. Real Capital Analytics and Linneman Associates report a stark drop in inflation-adjusted transaction volume in Q3 of 2023, plummeting to $88.7 billion from $189.3 billion the previous year, a far cry from the peak of $392.1 billion in late 2021. As of March 2024, the capital influx into CRE remains sluggish.

Post-Fed’s December 2023 guidance, the consensus is that we’ve reached the zenith of the interest rate hike cycle. This shared belief is pivotal for reactivating the CRE transaction market. With clearer signals from the Federal Reserve, buyers are regaining confidence in their valuation models for potential acquisitions.

Further buoying this sentiment is the FOMC’s projection of a 250 basis point reduction in the Fed Funds rate by 2026’s end. However, looming loan maturities cast a shadow over the sector, with about 20% of outstanding loans, or $929 billion, due in 2024—a 28% uptick from 2023. Fitch Ratings anticipates the delinquency rate for commercial mortgage loans to more than double from 2.25% in 2023 to 4.5% in 2024 and 4.9% in 2025. For context, during the 2008-2010 financial crisis, the delinquency rate averaged 6.96%.

As we dissect these developments, it’s clear that the CRE market is at a critical juncture, with capital flow dynamics and interest rate forecasts shaping its future. Stay tuned to this blog for ongoing analysis and insights into the evolving CRE landscape.

Leave a comment